Securing a green card through investment in real estate is a pathway that’s gaining traction among those looking to become permanent residents in the US. As I delve into the intricacies of this process, it’s clear that it isn’t just about the money—it’s a strategic move that can open doors to new opportunities. For those considering this route, understanding the US investor visa requirements is crucial.

The real estate market, with its potential for appreciation and rental income, presents a dual advantage for investors: a tangible asset and a ticket to residency. I’ll explore how investing in property can lead to a green card, what the thresholds are, and the kind of commitment you’ll need to make. This isn’t just about finding a new home—it’s about making a smart investment that aligns with your long-term residency goals.

Understanding the US Investor Visa Requirements

Investing in US real estate offers a tangible opportunity to not only leverage market dynamics but also to pave the way for residency. As I peel back the layers of the US investor visa program, it’s clear that understanding the requirements is crucial for aligning investment strategies with immigration goals.

At the heart of the investor visa is the EB-5 Immigrant Investor Program. It’s designed to stimulate the US economy through job creation and capital investment by foreign investors. The rules are specific: invest a minimum of $1 million in a new commercial enterprise, or $500,000 if the project is in a Targeted Employment Area (TEA), which typically includes rural regions or areas with high unemployment.

Job Creation is a Pillar: Each EB-5 investor must create or preserve at least 10 full-time jobs for qualifying US workers within two years of the immigrant investor’s admission to the United States as a Conditional Permanent Resident.

It’s also imperative to prove that the invested funds were obtained lawfully, whether through income, sale of property, inheritance, gift, or a legitimate business. The USCIS scrutinizes this aspect, so I always advise clients to prepare comprehensive documentation showcasing the legal origins of their capital.

Risk is inherent in the EB-5 investment, and the visa requires that the capital is at risk for the purpose of generating a return. Simply put, the investment must have a chance of loss and a chance for gain. Passive investments like owning a home do not satisfy this criterion.

The real estate component specifically must involve more than merely purchasing property. To qualify for an EB-5, the investment should fuel a business that actively engages in some form of commercial activity. This often involves developing new housing complexes, commercial spaces, or revamping outdated structures to generate economic growth.

Keeping abreast of policy shifts is another key element I emphasize. The US government frequently updates visa regulations, which can directly impact investment strategies. Staying vigilant about these changes ensures that the path to a green card through investment remains clear and attainable.

Reflecting on these requirements, it’s evident that securing a green card through real estate investment demands strategic planning and meticulous adherence to immigration stipulations. I’ve seen clients succeed by approaching this with due diligence, patience, and a clear understanding of the complex interplay between investment and immigration laws.

The Dual Advantage of Real Estate Investment

Real estate investment for a green card is not just about securing permanent residency in the US; it offers a dual advantage. As an investment strategy, it presents the potential for capital growth and passive income. From my experience in financial advising, I’ve seen how real estate can serve as a stable investment in contrast to the often volatile stock market. This stability coupled with the perks of living in the US provides an attractive package for investors.

Potential for Capital Appreciation

- Long-term increase in property value

- Stability in growth compared to other assets

- Hedge against inflation

Real estate naturally tends to appreciate over time. I’ve observed properties in strategic locations not only retain their value but also experience significant appreciation. Unlike stocks, where value can drastically fluctuate, the gradual increase in real estate prices can offer a more predictable path to wealth accumulation.

- Steady stream of rental income

- Direct control over cash flow

- Asset diversification

One aspect that I emphasize with my clients is the ability to generate passive income through rentals. This isn’t a mere theoretical benefit; real estate investments have yielded tangible rental revenues for many of my clients. Owning property can mean consistent cash flow, and as the property owner, you have significant control over these earnings. Moreover, diversification is a cornerstone of any robust investment strategy, and real estate provides an ideal vehicle to diversify one’s portfolio away from solely paper assets.

Investing in US real estate for the purpose of obtaining a green card also includes other benefits such as the potential for tax deductions and an introduction to the US real estate market, which can be valuable knowledge for further investment. With the right property and management, the returns can be both financially rewarding and crucial for securing a Visa. It’s important to understand that while there are advantages, when we’re talking about investment, we’re also talking about risk. Realizing those risks and actively managing them is part of the strategic planning necessary for a successful investment endeavor.

How Investing in Property Can Lead to a Green Card

Investing in US property offers more than just a potential return on investment or passive income; it can be a pathway to a Green Card through the EB-5 Investor Visa Program. I often remind clients that real estate investment is not just about the bricks and mortar – it’s about leveraging capital in a way that can also secure residency rights.

The EB-5 Visa requires investors to engage in a new commercial enterprise which creates jobs and drives economic growth within the US. This program has clear stipulations regarding the minimum investment amount and the number of jobs that must be created. Investing in real estate, such as developing a new commercial or residential project, can meet these criteria if the project creates the necessary employment opportunities.

To navigate this process, investors must understand that the real estate project must be structured correctly to comply with EB-5 requirements. Due diligence is critical in selecting the right project. It’s not enough to purchase property; the investment must also translate into a viable business venture that has a tangible impact on the job market. I’ve seen many clients thrive by focusing on projects that are part of larger developments, often in collaboration with experienced regional centers that specialize in managing EB-5 investments.

Another crucial aspect investors need to account for is the source of funds. The US Citizenship and Immigration Services (USCIS) requires a thorough trail proving that investment funds were obtained through lawful means. This involves extensive documentation, which I recommend preparing with legal assistance. Additionally, the invested amount must be at risk for the purpose of generating a return; therefore, it cannot be a loan that is secured by the real estate and guaranteed to be returned to the investor.

By approaching real estate investments with a strategic eye towards fulfilling EB-5 requirements, investors can enhance their chances of not only growing their financial portfolio but also establishing permanent residency in the US. It’s a complex process with significant benefits, which demands careful planning and consultancy with professionals well-versed in immigration law and real estate investment.

Thresholds for Obtaining a Green Card through Real Estate Investment

In navigating the pathways to U.S. residency, the financial thresholds play a crucial part in the discussion. It’s not just about the quality of the investment but about meeting the set monetary standards. The minimum investment amount crucial to the EB-5 Investor Visa Program for obtaining a Green Card through real estate investment varies depending on the location of the project.

For investments in Targeted Employment Areas (TEAs), which are either rural areas or those with high unemployment rates, the requirement is less stringent. I’ve consistently advised clients that the reduced amount can significantly lower the entry barrier for obtaining residency.

| Location Type | Minimum Investment Amount |

|---|---|

| Targeted Employment Area | $900,000 |

| Non-Targeted Employment Area | $1,800,000 |

These numbers are subject to change based on periodic revisions by the United States Citizenship and Immigration Services (USCIS). It’s paramount to stay abreast of these updates as they can greatly impact investment strategies and decisions.

Another threshold to consider is the job creation requirement. The investment must lead to the creation of at least 10 full-time jobs for U.S. workers. These jobs must be created within two years of the immigrant investor’s admission to the United States as a Conditional Permanent Resident.

Beyond these primary requirements, there are numerous nuances to consider:

- The investment must be at risk – implying it’s not merely a passive purchase of real estate, but an active contribution to an enterprise with potentials for gain and loss.

- Funds invested must be traced back to legitimate sources. This involves thorough documentation to satisfy not only USCIS compliance but also any financial institution’s anti-money laundering procedures.

- With the rise of regional centers, I’ve witnessed many investors opt for these entities as a pathway to residency. They pool investments and are often involved in numerous projects that qualify under the EB-5 program.

Staying updated on the latest regulations, consulting with immigration attorneys, and developing a robust financial analysis are steps I cannot emphasize enough when pursuing a Green Card through real estate investment.

Commitment Required for Green Card through Real Estate Investment

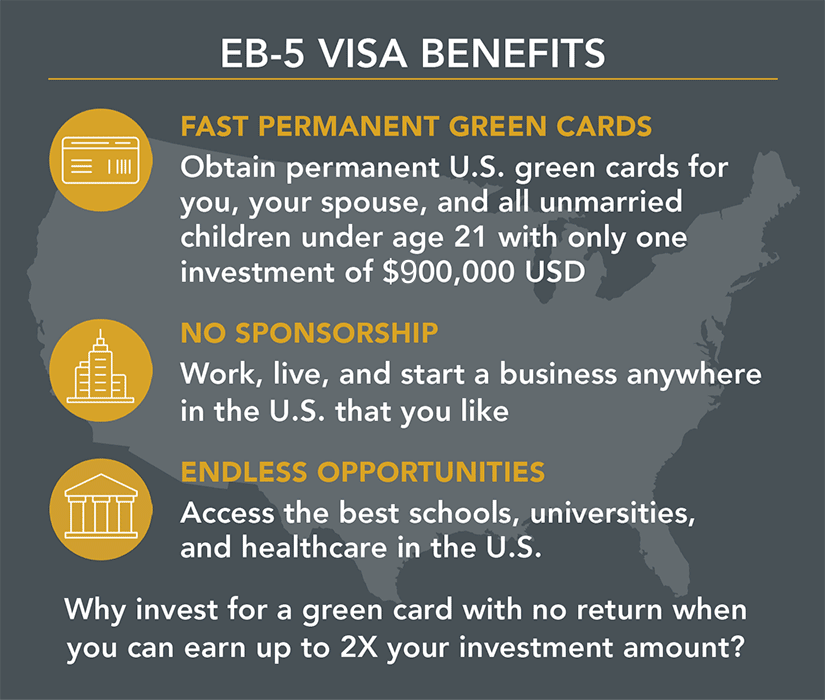

Investing in real estate with the aim to secure a Green Card under the EB-5 Investor Visa Program isn’t just a financial commitment—it’s a personal one as well. I’ve guided numerous investors through this process, and it’s clear that the journey involves more than just writing a check. For starters, the financial commitment is substantial. The minimum investment amount required is $1.8 million, or $900,000 in a Targeted Employment Area (TEA). These aren’t just arbitrary numbers; they’re designed to ensure that investors are seriously committed to contributing to the US economy.

Aside from the financial aspect, investors need to be prepared for a lengthy and detailed application process. It’s not uncommon for the entire process to take several years from the initial investment to the granting of the conditional green card. This requires patience and a long-term perspective.

Documentation is key in demonstrating both the legitimacy of funds and the credibility of the investment. Investors must show a clear and lawful path of the funds used for the investment. This can sometimes be a complex process, especially for those with multi-layered finances.

Another aspect that demands commitment is the job creation requirement. The investment must lead to the creation of at least ten full-time jobs for US workers within two years of the immigrant investor’s admission to the US as a Conditional Permanent Resident.

| Requirement | Criteria |

|---|---|

| Investment Amount | $1.8 million or $900,000 in a TEA |

| Job Creation | 10 full-time jobs for US workers |

| Application Duration | Several years from investment to Green Card |

| Fund Legitimacy | Clear path of funds required |

While the process is rigorous, the EB-5 program can provide investors with a path to residency that is tied to potentially profitable investments. Unlike other visa options, the EB-5 enables a direct route to gaining conditional, and eventually, permanent residency status—if one fulfills all the requirements. Of course, this is why it’s crucial to stay abreast of policy changes and seek continuous advice from professionals like me who’ve spent years working in the intersection of immigration and investment. The commitment required goes beyond the initial monetary investment—it’s an investment in careful planning, compliance, and patience.

Conclusion

Securing a Green Card through investment in real estate is undoubtedly a complex journey that demands a significant financial outlay and meticulous attention to detail. It’s vital to weigh the potential benefits against the stringent requirements and to approach this path with a clear understanding of the commitment involved. Whether it’s for the promise of profitability or the allure of permanent residency, I believe that with the right guidance and a thorough due diligence process, investors can navigate this terrain successfully. Remember that staying informed and working with seasoned professionals can make all the difference in achieving your immigration and investment goals.

Frequently Asked Questions

What financial thresholds must be met to obtain a Green Card through real estate investment in the US?

Successful applicants must meet the EB-5 program’s financial thresholds, which vary based on the project’s location. Generally, investors need to commit $1.05 million, or $800,000 for a project in a targeted employment area.

Is job creation a requirement for the EB-5 Investor Visa Program?

Yes, the EB-5 Investor Visa Program requires each investment to create or preserve at least 10 full-time jobs for qualifying US workers within two years of the investor’s admission to the United States as a Conditional Permanent Resident.

What does “investment at risk” mean for the EB-5 program?

For the EB-5 program, “investment at risk” means the investor’s capital must be subject to both gain and loss, demonstrating a real financial commitment to the enterprise’s success.

How can an investor prove the legitimacy of their investment funds?

Investors must provide documentation tracing the funds back to legitimate sources, confirming that the capital invested in the EB-5 project was obtained through lawful means.

Why is it important to stay updated on the latest EB-5 regulations?

Regulations for the EB-5 program can change, affecting investment amounts, procedures, and eligibility. Staying updated ensures compliance and maximizes the chances of a successful Green Card application.

What level of commitment is required when obtaining a Green Card through real estate investment?

Obtaining a Green Card through real estate investment requires a substantial financial commitment, adherence to a detailed application process, job creation, and a thorough financial analysis to determine project viability.

Can investing in real estate through the EB-5 program be profitable?

Yes, while the primary goal is to obtain a Green Card, investments made through the EB-5 program have the potential to be profitable. However, profitability depends on the success of the real estate project.

Why is it advisable to seek professional advice when investing for a Green Card?

Immigration laws and investment details are complex. Professional advice from immigration attorneys and financial advisors helps ensure that all regulations are met and the investment is sound.