Starting a business in the United States is a dream for many entrepreneurs around the world. It’s not just about tapping into a market with immense potential; it’s also about the possibility of securing a future in the US. The question I often hear is, “Can opening a business lead to a green card?” The answer isn’t straightforward, but under the right circumstances, it’s a definite possibility.

Navigating the complex immigration pathways can be daunting, but there’s a beacon of hope for investors and business owners through the US Investor Visa program. This initiative opens doors for those looking to invest in the American economy, possibly leading to permanent residency.

Understanding the legal requirements and steps involved is crucial. I’ll dive into the specifics, helping you grasp how your entrepreneurial spirit could potentially pave the way to a green card.

How to Get a Green Card by Opening a Business

Embarking on the journey to obtain a green card through business ownership comes with both excitement and significant responsibility. The U.S. Investor Visa program is the key to unlocking this door. There are two main options: the EB-5 Immigrant Investor Program and the E-2 Treaty Investor Visa. While the EB-5 leads directly to a green card, the E-2, which is not a direct path to permanent residency, can be a stepping stone when managed strategically.

Start with the EB-5 Program

Diving into the details of the EB-5 program is crucial. To qualify, I’ve learned that you need to invest a minimum of $1.8 million, or $900,000 in a Targeted Employment Area (TEA). This program mandates the creation or preservation of at least 10 full-time jobs for U.S. workers within two years. The Department of Homeland Security scrutinizes these investments to ensure compliance with all regulations.

EB-5 Investment Requirements:

| Requirement | Standard Investment | TEA Investment |

|---|---|---|

| Minimum Investment Amount | $1.8M USD | $900K USD |

| Job Creation | 10 full-time | 10 full-time |

Explore the E-2 Visa as an Alternative

For nationals of countries with a Treaty of Trade and Commerce with the United States, the E-2 visa becomes an option. It requires a “substantial investment” in a bona fide enterprise—usually significantly less than EB-5. The E-2 visa can be renewed indefinitely as long as the business operates. However, it doesn’t directly grant permanent residency.

Prepare a Comprehensive Business Plan

Regardless of the path chosen, a comprehensive business plan is non-negotiable. This plan should clearly outline:

- The nature of the business.

- Your investment amount.

- Job creation plans.

- A realistic projection of growth and revenue.

Immigration authorities expect a robust business plan that demonstrates a clear path to success and benefit to the U.S. economy.

Exploring the US Investor Visa Program

As someone who’s guided clients through the intricacies of the US Investor Visa Program, I’ve seen firsthand how this pathway can be both an opportunity and a complex challenge. In my experience, thorough knowledge and meticulous planning are the keys to leveraging this program for gaining a green card.

The EB-5 Immigrant Investor Program is often the focal point for those looking to secure a green card through investment. Let me break it down: to meet the criteria, you must invest either $1.8 million or $900,000 in a TEA and create at least 10 full-time jobs for qualifying US workers. The lower investment threshold applies to rural areas or regions with high unemployment.

What’s critical here is the source of funds. It must be legal, and you need to prove that. Often overlooked, this step is crucial for a smooth application process. I can’t stress enough how meticulous one must be about the documentation, a lesson I’ve learned through assisting numerous clients.

Another aspect is the investment itself. It’s not about merely putting money in; the investment must be ‘at risk’. In simple terms, there should be a genuine chance of gain or loss – a point that’s not always comfortable for every investor, but necessary under the program’s guidelines.

For clients who can’t afford the EB-5 or come from non-treaty countries, I often discuss the E-2 Treaty Investor Visa. It’s a nonimmigrant visa, but for many of my clients, it’s a step toward a more permanent move later on.

Investment sufficiency and business viability are critical for the E-2. You must show a substantial investment in a bona fide enterprise and that the business can support more than just you and your family. It’s about demonstrating that your business will have a tangible impact on the US economy.

In evolving my own advising strategies, I’ve learned to focus on the long-term. While the initial visa may not grant permanent residency, it can lay the groundwork for future status changes. And in this complex landscape, foresight is indeed a virtue.

The Benefits of Investing in the US Economy

Investing in the United States offers a robust portfolio of opportunities that can yield significant benefits for foreign investors. As someone who’s delved deep into financial markets, I’ve observed the tangible impacts that foreign investment can have on both individual portfolios and the broader economy.

Strategic Market Access is one of the primary advantages of investing in the US. By establishing a business here, investors position themselves within one of the world’s largest markets, offering a diverse consumer base and a stable political climate. This environment provides a fertile ground for business growth and expansion.

Another key benefit is the Potential for High Returns. The US economy is known for its dynamic nature, which can lead to profitable investment opportunities. Here’s what I’ve witnessed:

- Innovative sectors that contribute to rapid business growth.

- Business-friendly laws, which encourage investment.

Opening a business in the US also provides Legal Protections and Intellectual Property Rights that might not be as strong or as enforced in other countries. These protections are crucial for businesses that depend on proprietary technology or creative products.

Furthermore, investing in the US can lead to improved Global Brand Recognition. Operating a business in such a prominent economy can elevate a brand, enhancing its prestige and perceived value worldwide.

In terms of networking, there’s a Synergy with Other Businesses that can be incredibly beneficial for growth. The US is home to many industry leaders and innovators, and by setting foot in the US market, businesses can align and collaborate with these entities.

Finally, I’ve seen how establishing a business in the US can act as a gateway to Diversification. The variety of sectors and investment alternatives can help mitigate risks associated with market volatility in an investor’s home country.

For those who’ve analyzed the various visa programs, it’s clear that the United States actively courts and facilitates foreign investment. This endeavor is not just to inject capital into the economy but also to drive innovation, job creation, and diversification of the business landscape.

While the processes might be complex and require substantial investment, the potential payoff in both economic and personal terms might just be worth the effort for those looking to make their mark in the global marketplace.

Understanding the Legal Requirements

When considering opening a business in the United States with the goal of obtaining a green card, it’s essential to comprehend the myriad legal requirements involved. The process isn’t straightforward, and it’s vital to approach it with a full understanding of the obligations and eligibility criteria.

The EB-5 Investor Visa is often the most direct path for those looking to invest in a new commercial enterprise that can potentially lead to a green card. To qualify, I’ve seen clients invest a minimum of $1.8 million, although this amount drops to $900,000 if the investment is made in a Targeted Employment Area (TEA). These investments must lead to the creation or preservation of at least 10 full-time jobs for U.S. workers within two years.

While the EB-5 is a popular option, there are other pathways, such as the E-2 Treaty Investor Visa. This doesn’t directly lead to a green card but can provide long-term residency for investors from countries that have a Treaty of Commerce and Navigation with the U.S. Investors must demonstrate that they have invested, or are in the process of investing, a substantial amount of capital in a bona fide enterprise in the U.S., and they must hold at least 50% ownership or possess operational control.

Each visa type comes with its unique set of challenges and requirements. Here are the critical areas to focus on:

- Ownership and Control: You need to prove that you have a controlling interest in the business.

- Active Commercial Enterprise: The business must be for-profit, lawful, and engage in regular, ongoing activities.

- Job Creation: You must show a clear plan for creating or keeping a required number of jobs.

- Capital At Risk: Your investment must be at risk for the purpose of generating a return.

Navigating the legal complexities is overwhelming for many of my international clients. That’s why I often recommend consulting with an immigration attorney who specializes in business and investor visas. They can provide personalized guidance and ensure that all the necessary paperwork is in order, mitigating the risk of unforeseen roadblocks that could jeopardize the entire endeavor.

Steps to Securing a Green Card

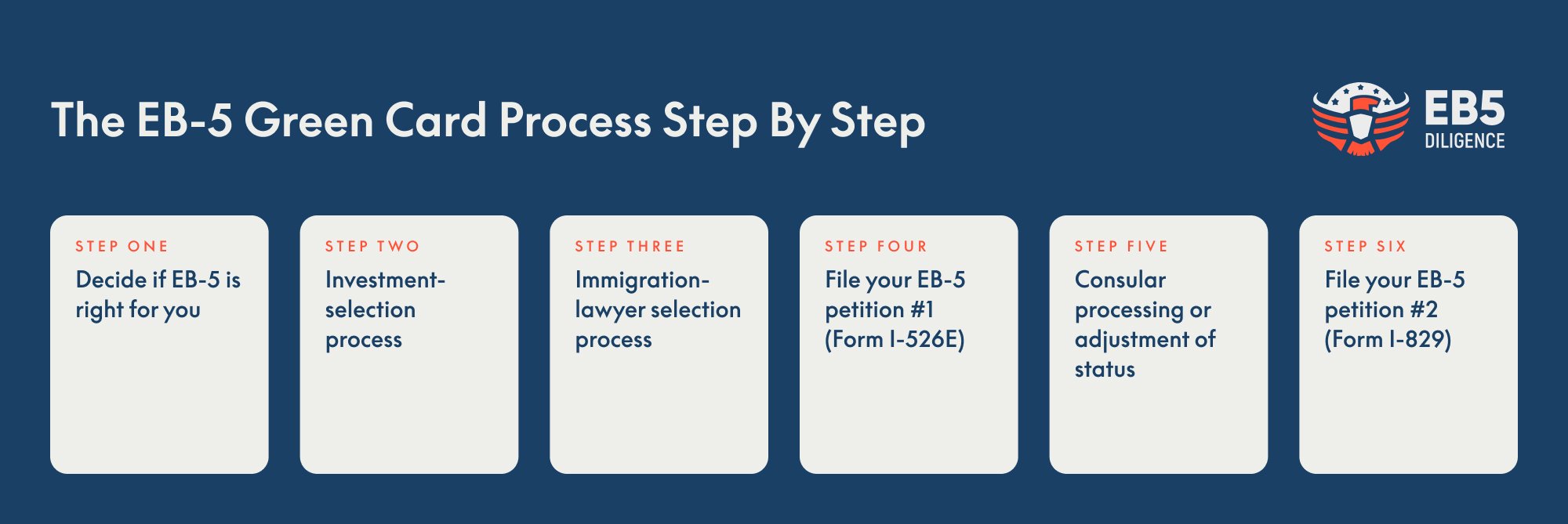

When looking to secure a green card through business ventures, there are specific steps you’ll need to follow. It’s crucial to understand that this journey is multifaceted, involving both immigration and business acumen.

Firstly, select the appropriate visa category that aligns with your business objectives. As previously discussed, the EB-5 Investor Visa is an optimal choice for those looking to invest substantial funds into a new commercial enterprise. The E-2 Treaty Investor Visa serves those from treaty countries wishing to operate a business in the US actively.

Once you’ve chosen your visa path, the next step is to develop a detailed business plan. This should outline the nature of the business, your investment amount, job creation plans, and how the business will contribute to the US economy. Evidence of this plan is critical for your visa application, showcasing to immigration authorities that your intentions are serious and your business is viable.

Another essential step is acquiring or setting aside the investment funds. This money must be lawfully obtained and traceable. Investment amounts vary depending on the visa and whether or not you’re investing in a TEA. Remember, as per the EB-5 visa requirements, you must invest:

- $1.8 million, or

- $900,000 in a TEA

After your capital allocation, you must focus on job creation. The EB-5 program mandates the creation of at least 10 full-time jobs for qualifying US workers within two years of your investment. This isn’t just a number—it’s a commitment that holds significant weight in the success of your green card application.

It’s essential to continuously monitor and document the progress of your investment in relation to job creation and business growth. Regular updates may be needed for legal filings and to support your immigration status adjustments.

Naturally, with legal matters this complex, engaging with an immigration attorney who specializes in business and investor visas is non-negotiable. They will help ensure all legal requirements are met, documentation is properly addressed, and deadlines are timely managed.

Conclusion

Securing a green card through opening a business is a complex but achievable goal. It’s crucial to navigate the process with precision and care, ensuring each step from choosing the right visa to documenting your investment’s impact is handled meticulously. Remember, success in this endeavor isn’t just about starting a business—it’s about fostering growth and job creation. I strongly recommend partnering with a seasoned immigration attorney to guide you. Their expertise can make all the difference in turning your entrepreneurial dreams into a reality that also paves the way for your life in the United States.

Frequently Asked Questions

What is the best visa category for securing a green card through business ventures?

To secure a green card through business ventures, the best visa category largely depends on the individual’s situation. The EB-5 Immigrant Investor Program is a common option, allowing investors to become permanent residents by investing in a U.S. business that will create or preserve 10 permanent full-time jobs.

How important is a business plan in the green card application process?

A detailed business plan is crucial as it outlines the feasibility and economic impact of your venture, which is a key requirement for visa applications like the EB-5. It must detail how the business will create or maintain employment and provide a roadmap for success.

What are the requirements for investment funds when applying for a business-related green card?

Investment funds for a business-related green card must be legal, substantial, and at-risk for the purpose of generating a return. The exact amount required depends on the visa category; for example, the EB-5 program typically requires a minimum investment of $900,000 or $1.8 million, depending on the location of the business venture.

Why is job creation important for securing a green card through business?

Job creation is a key factor for securing a green card through business ventures as it fulfills one of the main purposes of the investor visa categories such as the EB-5, which is to stimulate the economy by creating U.S. jobs.

Should I consult an immigration attorney for my business-related green card?

Yes, it’s advisable to consult an immigration attorney who specializes in business and investor visas. They can offer personalized guidance, ensure you meet all legal requirements, and help navigate the complexities of the application process.