Navigating the complexities of the EB-5 investment visa program can be daunting, but understanding the investment amount is crucial for potential investors. It’s a pathway that offers a green card in exchange for significant economic contributions to the US, and the stakes are high. With recent changes and updates, it’s vital to stay informed about the financial requirements that could shape your future.

For many, the EB-5 visa represents a dual opportunity: a chance to invest in a thriving market and secure a future in the United States. If you’re considering this route, you’ll want to explore the intricacies of the US investor visa to ensure you’re making a well-informed decision. Let’s dive into what you need to know about the EB-5 investment amount.

Understanding the EB-5 Investment Visa Program

Embarking on the journey of an EB-5 investment isn’t just about planting monetary seeds in U.S. soil; it’s a strategic move towards securing a robust financial future while gaining residency. I’ve often advised clients that one of the program’s core components is the investment amount, which hinges on whether the project is in a Targeted Employment Area (TEA) or not.

Projects within TEAs, which are either rural or have high unemployment rates, require a lower investment threshold. I’ve seen many investors breathe a sigh of relief when they realize that their dream project qualifies for this reduced amount, making their pathway to a green card more accessible. For projects not in a TEA, the investment amount increases significantly, echoing the increase in potential risk and reward.

The investment amounts are not stagnant; they’re subject to change based on regulations and economic shifts. It’s critical to stay abreast of these changes:

| Location | Investment Amount (USD) |

|---|---|

| TEA Project | 800,000 |

| Non-TEA | 1,050,000 |

Navigating the EB-5 program, I’ve learned that it’s not just about meeting these financial benchmarks. There’s also the imperative of ensuring that the investment leads to the creation or preservation of at least ten full-time jobs for qualifying U.S. workers, which is a central tenet of the program.

In my experience, the key to a successful EB-5 investment lies in diligent research and partnership with experts who grasp the nuances of the program. From selecting the right regional center to understanding the job creation requirements and preparing a failsafe investment plan, the EB-5 route demands a multifaceted approach. Strategic planning can make all the difference in not only meeting the visa requirements but also in ensuring the investment’s growth potential is maximized for the investor’s future in the U.S.

Importance of the Investment Amount

When we dive into the specifics of the EB-5 investment visa, the actual size of your investment isn’t just a ticket to a green card—it’s a strategic move with implications for your financial growth. Throughout my career, I’ve advised numerous clients that underestimating or overestimating this critical figure can lead to significant ramifications, both for immigration compliance and financial health.

The minimum investment amount is often seen as a barrier to entry, but it’s also a reflection of your commitment to the program and the U.S. economy. In my consultations, I’ve emphasized that aligning your investment with the required minimum—$1.05 million or $800,000 for non-TEA and TEA projects respectively—is just the starting point. Here’s why getting this number right matters:

- Regulatory Compliance: Ensuring that the investment meets USCIS criteria is non-negotiable. Anything less and you’re risking your visa petition.

- Job Creation: Your investment has a direct impact on the U.S. labor market, a core component of the EB-5 program. It’s essential to have a plan for how your investment will lead to the creation or preservation of the required ten full-time jobs.

Investing more than the minimum can sometimes offer additional security and growth potential, but it’s crucial to analyze the risks and returns carefully. In my experience, the best approach is a well-researched, balanced investment that solidifies your immigration case and aligns with your long-term financial goals.

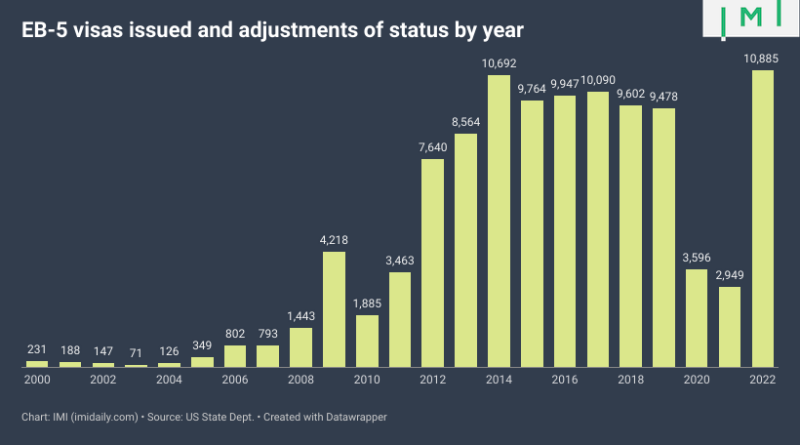

Considering the fluctuating nature of regulations and economic landscapes, it’s vital to stay current with the latest developments. The investment thresholds have changed over the years, and they could very well change again. I keep a keen eye on these trends to advise my clients accurately, ensuring they’re prepared for any shifts that could affect their investment or immigration status.

In my advisory role, I’ve stressed the importance of working with experts in both financial planning and immigration law. The key is to create a robust investment strategy, allowing you to make an informed decision about where and how much to invest. Remember, this isn’t just about securing a visa; it’s about setting the foundation for future wealth in a thriving economy.

Overview of the EB-5 Investment Amount

In navigating the complexities of the EB-5 investment visa program, it’s vital to grasp the financial requirements involved. The minimum investment amount, often a subject of legislative change, currently stands at $900,000 for targeted employment areas (TEAs) and $1.8 million for non-TEAs. These figures aren’t random; they reflect the program’s goal to stimulate economic activity.

I’ve seen investors approach this threshold from different angles. Some opt for the minimum, aiming to meet the requirement with surgical precision. They leverage their investment to not only secure a green card but also to carve out a slice of the American economic pie with calculated risk. On the other hand, some investors see the merit in exceeding the minimum, taking comfort in the greater security this might provide for their immigration status and financial future.

To truly understand these numbers, let’s breakdown the investment categories:

| Investment Type | Minimum Amount |

|---|---|

| Targeted Employment Area (TEA) | $900,000 |

| Non-Targeted Employment Area | $1.8 Million |

Investing in a TEA is appealing due to the lower threshold, but it also often involves higher risk, as TEAs are typically regions with higher unemployment or rural areas. My experience tells me that while the reduced amount is enticing, the due diligence process should be equally stringent as with a larger investment.

Investors should also note that these amounts are subject to increase based on inflation and policy revisions. It’s crucial to remain abreast of these changes, as they can influence the timing and structure of your investment. For those considering the EB-5 visa, I always recommend a thorough review of current economic trends and forecasts. This review can provide valuable context for the investment amount and its potential for returns and job creation – the core of the program’s purpose.

Regular consultation with an immigration attorney and a financial planner is essential for staying compliant and making informed investment decisions. Remember, navigating the EB-5 investment visa isn’t just about meeting the legal criteria; it’s about smartly integrating your immigration goals with your financial objectives for a fruitful investment journey.

Recent Changes and Updates to the Investment Amount

The EB-5 investment visa program has always been subject to periodic changes and updates, often reflecting shifts in economic conditions and policy priorities. In 2019, significant revisions were introduced, among them the increase in the minimum investment amounts. These changes were implemented by the U.S. Citizenship and Immigration Services (USCIS), signaling the first major adjustment in nearly 30 years.

As I advise clients on the nuances of immigration investment, it’s imperative to stay abreast of these regulatory evolutions. The standard minimum investment jumped from $1 million to $1.8 million, while investments in TEAs saw an increase from $500,000 to $900,000. This was a pivotal moment for investors eying the TEAs for their lowered threshold. Furthermore, the definition of a TEA was updated to grant state and federal agencies more authority in designating such areas.

The investment landscape for EB-5 continually evolves. In 2021, a court ruling vacated the 2019 rule changes, temporarily reverting the minimum investment amounts back to their prior levels. However, this regulatory see-saw did not last long, and the original higher thresholds were reinstated. This back-and-forth creates a fluid situation that demands investors’ attention.

It’s important to highlight that these changes not only affect the investment thresholds but also bring modifications to the application process and adjudication procedures. At times, these updates can influence processing times and the prioritization of certain petitions.

When considering an EB-5 investment —

- Engage with the latest regulations.

- Analyze the economic implications.

- Prepare for varying scenarios in both the short and long term.

To effectively navigate this shifting terrain, collaborating with immigration attorneys and investment advisors who specialize in this area is invaluable. They can provide tailored guidance that aligns with ongoing regulatory adjustments and personal investment objectives. As I piece together my client’s financial narratives, staying informed and adaptable to these updates is a cornerstone of my service philosophy.

Considerations when Exploring the US Investor Visa

When exploring avenues for investment in the United States, specifically through the EB-5 investor visa, it’s important to delve beyond the surface of minimum investment amounts. Given the recent updates to the EB-5 program, there are several crucial factors I advise clients to consider as they embark on this journey towards US residency.

Eligibility Requirements remain at the forefront of considerations. It’s not only about having the necessary capital but also proving that the funds were obtained legally. The source of funds requires exhaustive documentation, which can be a daunting task. Investors must be able to trace their investment back to a legal source, such as income, sale of assets, or gifts.

Project Assessment is also pivotal. Not all EB-5 investment opportunities are created equal. The viability of the project, its potential to maintain or create the required number of jobs, and the ability to sustain your investment, should all be scrutinized. Due diligence is a non-negotiable; it’s vital to understand where every dollar is going and the risks involved.

Moreover, navigating the Regulatory Environment is a challenge in itself. With regulations frequently changing, investors must remain vigilant about compliance. Even after investing the necessary amount, the process of securing the visa isn’t guaranteed and can be affected by the prevailing political and economic climate.

It’s also imperative to consider Financial Implications. While the end goal might be US residency, one shouldn’t overlook the investment’s financial return. After all, this is an investment in a business, and I encourage clients to evaluate it as they would any other investment opportunity.

Professional Expertise is something I cannot stress enough. Collaborating with experienced immigration attorneys and investment advisors who specialize in the EB-5 program is crucial. They can help navigate complex legal requirements, advise on project selection, and manage expectations based on the latest developments within the program.

From my experience, taking a strategic approach to the EB-5 investor visa can open doors to not just residency but also potentially lucrative investment opportunities. It’s about balancing the scales between the immigration benefits and the economic gains, ensuring that all actions are in accord with both personal and financial goals.

Conclusion

Navigating the EB-5 investor visa landscape requires a strategic and informed approach. It’s crucial to not only meet the minimum investment thresholds but also to thoroughly evaluate all aspects of potential projects and their implications for eligibility and financial success. I’ve highlighted the importance of professional guidance in this complex process. By doing so, you’re better positioned to capitalize on the opportunities that come with EB-5 investments and move closer to achieving residency in the United States. Remember, it’s not just about the funds you invest; it’s about how wisely you invest them.

Frequently Asked Questions

What is the minimum investment amount for the EB-5 visa program?

The minimum investment amount for the EB-5 visa program is generally $1 million. However, for targeted employment areas (TEAs), which are either rural areas or places with high unemployment, the minimum investment lowers to $500,000.

Are there specific eligibility requirements for the EB-5 investment visa program?

Yes, there are eligibility requirements for the EB-5 program. Investors must prove that the investment funds are from a lawful source, create at least 10 full-time jobs for U.S. workers, and actively engage in the business, among other conditions.

What should I consider when assessing a project for EB-5 investment?

Investors should consider the project’s financial viability, job-creation potential, management team’s track record, alignment with immigration goals, and risks versus rewards. Due diligence is crucial in assessing potential EB-5 investment projects.

Why is navigating the regulatory environment important for the EB-5 visa?

Navigating the regulatory environment is vital due to the complexities of immigration laws and the requirement for compliance with both investment and visa regulations. Understanding and adhering to these can prevent legal issues and investment losses.

Should I consult with a professional for my EB-5 investor visa application?

Yes, consulting with an immigration attorney or a financial advisor with experience in the EB-5 program is highly recommended. Professional guidance can help navigate the complexities of the program, ensure regulatory compliance, and optimize the chances of a successful visa application and investment outcome.